Industry body Chinese Photovoltaic Industry Association (CPIA) and Chuzhou People’s Government jointly organized the 2021 China Photovoltaic Industry Annual Conference and (Chuzhou) Photovoltaic Innovation and Development Summit Forum in Anhui Province from December 14-15.

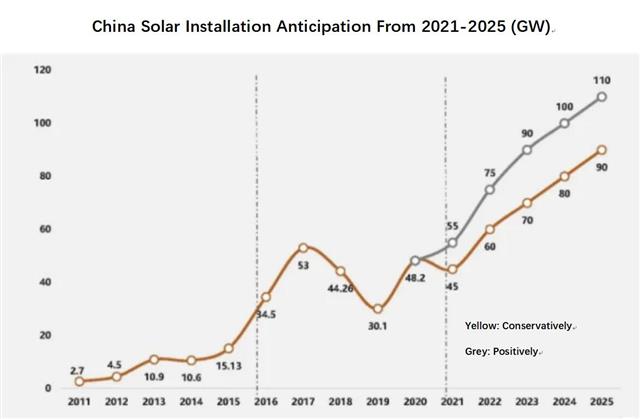

Wang Bohua, honorary chairman of CPIA, attended the event and made a keynote speech, pointing out that the country’s annual solar installation may reach 75 GW next year.

Source: CPIA, China Solar Installation Anticipation From 2021-2025 (GW)

Wang Bohua made a detailed introduction to the development of photovoltaic industry. In terms of photovoltaic manufacturing end, he pointed out that the growth momentum was strong in the first three quarters of 2021. The output of polysilicon was 360,000 tons, a YoY increase of 24.1%; Silicon wafer output was 165 GW, with a YoY increase of 54.2%; The cell output was 147 GW, with a YoY increase of 54.6%; The module output was 130 GW, a YoY increase of 58.5%. He said that although the development of the domestic market was less than expected, the overseas market achieved rapid growth, which drove the manufacturing to continue to develop.

Wang also highly praised the development of photovoltaic technology, especially in terms of conversion efficiency. In 2021, the average conversion efficiency of perc mono cells in China reached 23.1% and the highest reached 23.56%, which was only 22.8% in 2020. During the eight years since 2014, the silicon cell laboratory efficiency record of Chinese enterprises/research institutions has been broken 42 times, which have been refreshed 11 times this year. Among them, nine times for n-type cell technology, two times for p-type cell, eight times for TOPCon cell, and three times for heterojunction cell.

In terms of photovoltaic market, the installed capacity of first ten months of 2021 was 29.31 GW, a YoY increase of 34%, of which the distributed installed capacity was 19.03 GW, accounting for 64.9%. During the same period, the photovoltaic power generation was 273.8 billion KWh, a YoY increase of 22.8%, accounting for 4% of the total power generation, a YoY increase of 0.3%, and the average utilization rate was 98%. The newly residential installed capacity was 13.6 GW, of which the installed capacity in October accounted for 51.5% of the total installed capacity.

In terms of photovoltaic product export, the export of solar products of the first ten months of 2021 was about US $23.1 billion, a YoY increase of 44.6%. It is the third year in history in which the export volume of photovoltaic products exceeds US $20 billion.

Such growth resulted in two reasons, including increased module export volume (82.2 GW, a YoY increase of 32.2%), and soaring demand in overseas markets and rising prices.

During the first ten months of the year, the export volume of modules was US $19.83 billion, of which market areas such as Europe, Japan and Australia maintained strong demand, as well as emerging Pakistan and Greece. India and Brazil began to make efforts after the pandemic, with a very eye-catching performance.

According to statistics, the number of global photovoltaic gigawatt markets will increase to 26 in the next year from 20. Wang Bohua pointed out that such increase has enhanced the country’s impact resistance in international trade.

Despite the export increase, the country still face many challenges regarding to different markets in the world. China needs to export more than 60% of the solar products, while the forms of trade in overseas markets are severe, complex and diversified. Such as the anti-dumping and countervailing duty rules held by some European and American countries. Meanwhile, overseas freight rates are rising. In addition to the relatively stable routes between Japan and South Korea, the prices of several routes in South America, the United States and Europe have increased by 5-10 times.

Domestically, China is facing the risks brought by the general rise of supply chain prices to the development of the industry. According to the statistical information from January to September 2021, some raw materials such as industrial silicon, EVA resin, soda ash, electrolytic aluminum and chips are in short supply due to national control on energy and consumption.

*Copyrighted work, can not be duplicated, disseminated, or appropriated without permission