Indonesia has a photovoltaic potential of at least 207 GW and has always been one of the major photovoltaic markets in Southeast Asia. However, due to the lack of consistency, clarity and attractiveness of government regulations, the market has not experienced much growth in the past decade.

Solarbe Global has invited representatives from Berkeley Energy Indonesia, Quantum Power Asia and TÜV Rheinland Indonesia on September 22 to shed a light on local solar market on the topic of What Can Indonesia Do to Make it a GW-level Solar Installation Country.

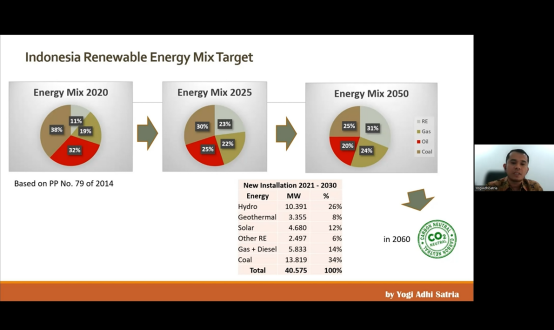

Yogi Adhi Satria, Business Development Manager of Berkeley Energy Indonesia started the session by talking about the solar energy opportunities in Indonesia, considering the updated regulation and circumstances. Satria has worked in EPC, power and renewable energy sectors for 10 years, and he illustrated on Indonesia renewable energy mix targets to achieve the country’s goal of realizing carbon neutral in 2060 based on the government’s regulation No. 79 of 2014.

In his presentation, he highlighted the solar opportunities in the country as in it possesses high irradiation potency and cheaper solar technology, Indonesia’s peak demographic bonus in 2030, international funding and global consensus on reducing carbon emission. Meanwhile, Satria concluded some of the challenges faced by solar energy, including over supply, deeply rooted preference in traditional energy, land unavailability, and regulation implementation uncertainty.

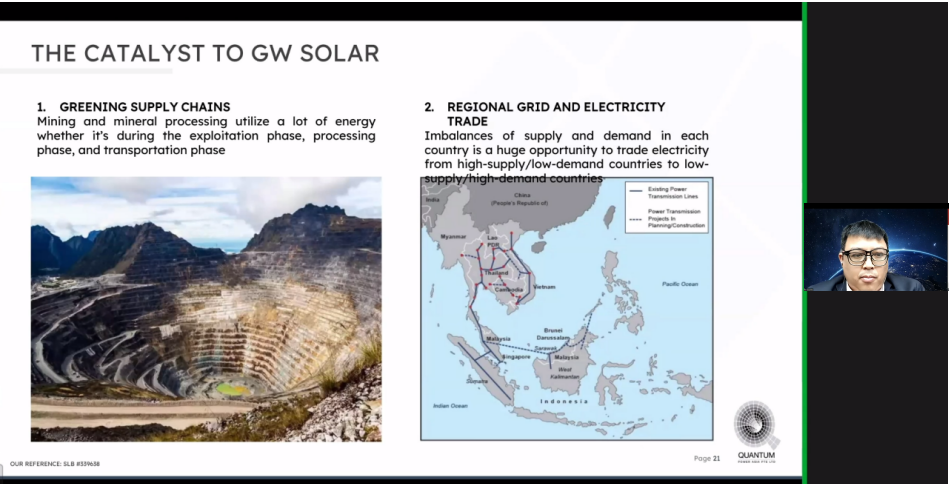

Followed by Andre Susanto, the Chief Technology Officer of Quantum Power Asia, who gave an overview from technological perspective. He believed regional grid and cross-country electricity trade would be a catalyst for giga-scale solar installation.

A screenshot of Andre Susanto’s presentation

According to Susanto, solar is the future of the country and one of the main technologies for electricity generation when traditional resources run out. Indonesia can also be a hub for solar pv industry in the region, or even the world, seen from the funding global consortium has invested, which could bring out 7-20 GW solar installation in the next 5-10 years. He concluded his speech by sharing his view on the actual execution and implementation of the projects, saying that the government needs to allow solar pv based electricity export to neighbor countries, which is totally beneficial and cost-free.

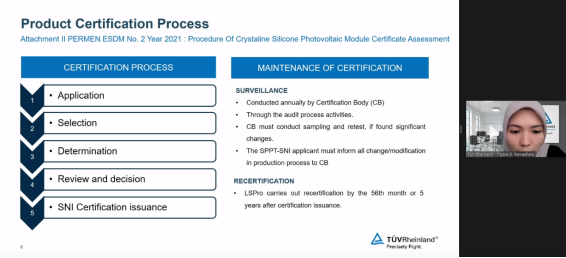

Thyara D. Ramadhany, Account Manager at PT TÜV Rheinland Indonesia introduced the process to acquire SNI Photovoltaic Certification, which is mandatory in Indonesia.

In 2021, the Regulation Ministry of Energy Resources and Mineral issued the Implementation of Standards Quality of Crystalline Silicone Photovoltaic Module that are enforced for both local and imported products. PT TUV Rheinland Indonesia is an accredited organization to issue the SNI Certificate. The certification process, according to Ramadhany, includes five stages, namely application, selection, determination, review and decision, and SNI Certification issuance.

She then highlighted several points in the evaluation stages and explained the determination process and application documents needed in detail. A to-do list for applicants to check after they get the SNI Certificate was also included in her presentation.

The whole process to obtain an SNI Certificate normally takes around five months, she added.

When asked about his opinions on highly fragmented structure of the grid and operating problems in off-grid areas, Susanto said that the national grid is not the company’s major concern as it involves complexities to deal with the PLN. Instead, the company focuses on isolated grids owned by private companies. Currently, there are about 50 electricity supply business area licenses, which are basically utility companies at the same level as PLN.

As for project funding, Susanto said that the government doesn’t fund big projects. “They only fund remote area projects. If you want to build solar PV for commercial purposes, it’s not government funding. Government funding is only used to electrify villages and places where PLN cannot reach.”

Solarbe Global noticed that the average cost per megawatt of solar PV capacity in Indonesia is 65% higher than that in India and 10% higher than in Thailand. Satria pointed out that compared to a decade ago, the prices have become much cheaper. However, in the past three years, under the impact of COVID-19 and supply-demand imbalance, investment cost has gone up.

As the PLN has committed to stop building new coal-fired power plants after 2023 and aims to reach net zero by 2060, Susanto stressed that, besides the targets, it is also important for the government to create a viable business model around them. A lot of the coal projects and investors are not afraid of being curtailed as they have a PPA with the PLN that has a money-back guarantee. There’s also no incentives for the project investors of the coal power plants to phase out coal early.

The recording of the session is available here: https://www.solarbeglobal.com/indonesia-solar-market-development-global-market-series/